Kenya-UAE CEPA: Unlocking New Trade and Investment Avenues for Africa

Date Posted: February 03, 2025

Source: WAM.ae

Introduction: A Historic Trade Milestone

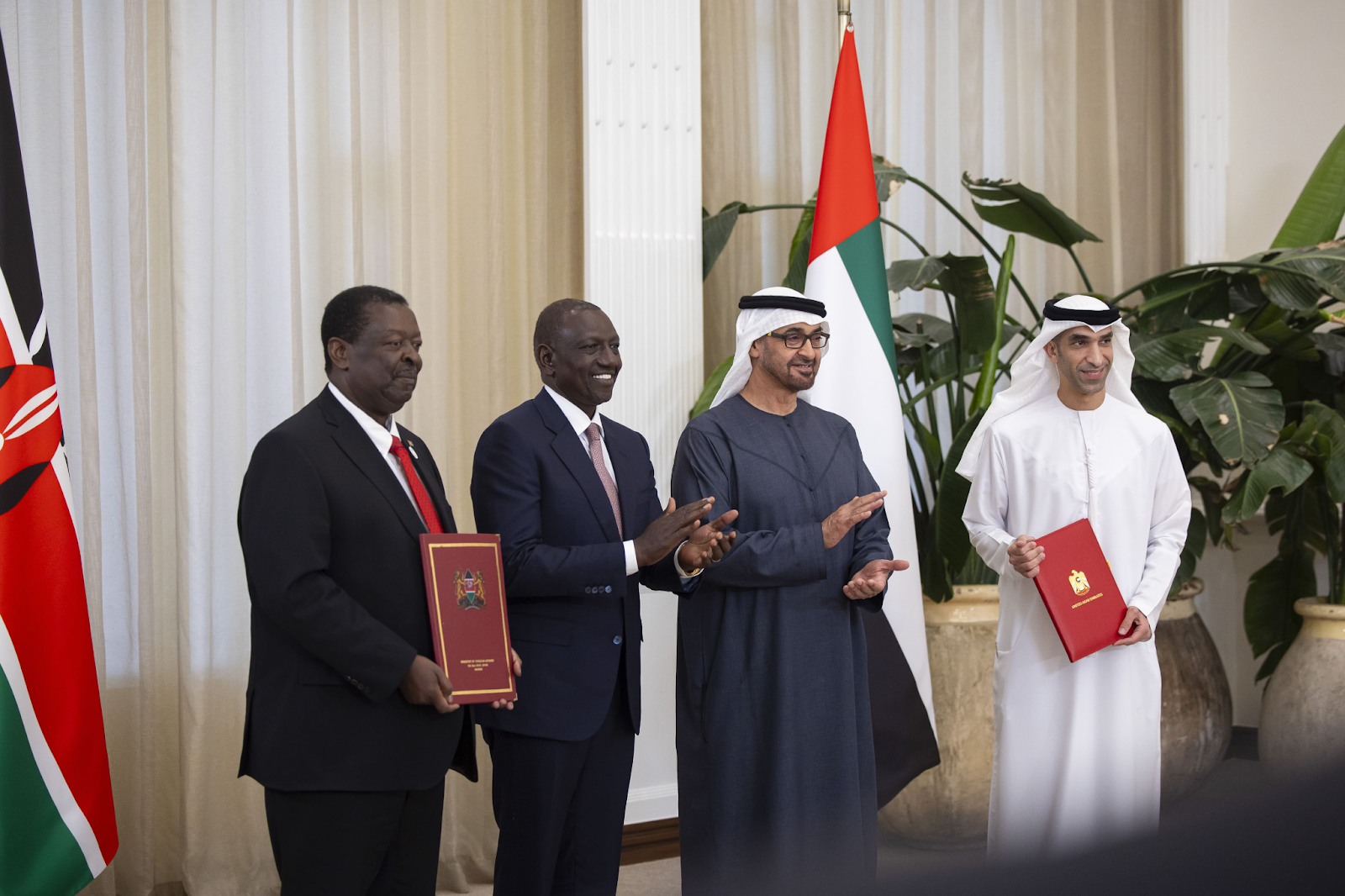

On January 14, 2025, Kenya and the United Arab Emirates (UAE) signed a landmark Comprehensive Economic Partnership Agreement (CEPA). This agreement, marking the first of its kind between the UAE and a mainland African country, is set to reshape the economic landscape not only for Kenya but for the East African Community (EAC) and broader African markets, especially in the context of the African Continental Free Trade Area (AfCFTA).

What is a CEPA?

A Comprehensive Economic Partnership Agreement (CEPA) is designed to eliminate trade barriers, enhance investment flows, and encourage economic cooperation between two countries. The CEPA model goes beyond traditional free trade agreements (FTAs) by covering trade in goods, services, investment, intellectual property, and regulatory cooperation.

Key Provisions of the Kenya-UAE CEPA: Trade, Services, and Investment

UAE Non-Oil Imports from Kenya

Source: Source: UAE Ministry of Economy

1. Trade in Goods

Kenya-UAE Trade Volume: Trade between Kenya and the UAE has more than doubled in the last decade. In 2023, the total trade value was approximately about $3.5 billion USD. The UAE ranks as Kenya’s sixth-largest export destination and second-largest source of imports, representing 16% of Kenya’s total imports

Kenya’s Key Exports to the UAE:

Agricultural products, particularly meat ($76.74 million, representing 54% of Kenya’s total meat exports), fruits ($40.34 million), vegetables, and flowers ($43.41 million). These sectors will likely see expanded market access under the CEPA.

The Kenya Foreign Investment Report 2023 highlights that the agriculture sector has been a significant contributor to Kenya's trade with the UAE, with the UAE accounting for a significant portion of Kenya's agricultural exports. The manufacturing sector, too, is seeing increased FDI, growing by 57.6% in 2022

2. Trade in Services

The agreement allows Kenyan service providers to access the UAE market in a variety of sectors, including:

Education: The UAE’s growing education sector presents opportunities for Kenyan universities and training institutions.

Transport and Logistics: The UAE’s robust logistics infrastructure, particularly through Dubai and Jebel Ali port, will facilitate Kenyan exports and imports more efficiently.

ICT and Technology Transfer: Both nations have committed to promoting digital trade and technology transfer, which could help accelerate Kenya's tech ecosystem. In 2022, FDI in ICT rose by 20.5%, and is expected to benefit from increased collaboration with UAE businesses.

3. Investment Opportunities

Data: UNCTAD

The agreement outlines key sectors for joint investment, such as energy, agriculture, healthcare, and ICT. The UAE is already one of Kenya's largest foreign investors, particularly in real estate and hospitality. The Kenya-UAE CEPA is projected to increase FDI flows by 10% annually, based on historical trends and the strengthening of sectoral partnerships.

Key Investment Projects and Areas

Energy: UAE’s interest in renewable energy projects in Kenya aligns with global sustainability trends. The Dubai Electricity and Water Authority (DEWA) has already expressed interest in expanding its investments in Kenya’s solar and wind energy projects, valued at $500 million USD

Healthcare: Healthcare investment is projected to grow significantly, particularly in medical infrastructure and healthcare technologies. The UAE is poised to invest in Kenya’s healthcare sector, with a focus on hospitals and medical devices. Investments in healthcare and medical technologies saw a 15% increase in FDI inflows in 2022

Agriculture: As a major food importer, the UAE seeks secure agricultural supply chains. Direct investments in Kenya’s agricultural infrastructure are expected to exceed $200 million USD over the next five years

Implications for the EAC and AfCFTA

Source: EAC trade and investment report, 2023

1. Regional Trade Expansion

The EAC’s combined market of over 177 million people stands to gain from improved trade and investment access. In 2023, EAC’s total intra-regional trade increased by 13.1%, reaching $12.1 billion USD. This growth is expected to accelerate with the CEPA.

AfCFTA Synergies: The agreement exemplifies how AfCFTA can serve as a platform for further trade liberalization, with intra-African trade projected to rise as barriers are reduced and regional value chains are strengthened. As Kenya strengthens its ties with the UAE, it not only enhances its position within East Africa but also strengthens its role as a key partner within the AfCFTA framework.

2. Projections for Trade Growth

Increased Export Volumes: Kenya's exports are expected to grow by 15-20% annually over the next 3-5 years as a result of the CEPA’s provisions. This growth is expected to be driven by tariff eliminations and improved market access.

New Export Channels: Kenyan SMEs are expected to benefit from enhanced market intelligence, export facilitation services, and trade missions under the CEPA.

Implications for Businesses and Other African Markets

UAE-Kenya Trade

Source UAE Ministry of Economy

In 2023, the value of Kenya’s non-oil exports to the UAE reached approximately $840.9 million, a marked increase from $639 million in 2022, continuing a steady growth trend since 2014, when the value was $221.9 million. This upward trajectory highlights the growing importance of the UAE as a trade partner for Kenya and the promising impact of the CEPA in further boosting exports.

We will see more UAE businesses make strategic investments into Kenya as Kenya continues to position as a strategic gateway to East Africa, particularly in real estate, energy, manufacturing, and logistics sectors.

Dubai and Jebel Ali port offer critical infrastructure for supply chains that can integrate African exports into global markets, thus, the CEPA will also drive deeper trade relations with other African markets, creating a multiplier effect across sectors like technology, manufacturing, and energy.

Need Help? Get In Touch.

Our Trade Desk offers businesses the tools and expertise needed to succeed in the GCC and Africa trade corridor, providing personalized services tailored to your needs. Whether you need help with trade facilitation, navigating regulations, identifying key market trends, or establishing partnerships, our trade advisors are on-hand to assist. Contact us at tradedesk@casialab.com

_1687337514.jpg)

_1684612515.jpg)

_1666791043.jpg)

_1666790839.jpg)

_1666790690.jpg)

_1666790264.jpg)